Japan's public debt was 230% of its GDP in 2011. Still, in the current US situation in which a lot of dollars are owed overseas ($1.13 trillion to Japan, $1 trillion to China, or a net international indebtness of $4.03 trillion, 2011 figures) more deficit spending is not an optimal solution. Agreed, the $1 trillion platinum coin idea is a cynical response to Repugnant propaganda, but it does reveal a mindset common in Washington: as long as the government can create money by manipulating central bank accounts, it can go on spending. Eventually foreign bond buyers and dollar holders will get nervous and stop financing our profligate ways. Krugman claims he does not see any inflation, but then the price of food and gas are not even included in the consumer price index! What is needed is more revenue or less spending or both.

Tuesday, January 15, 2013

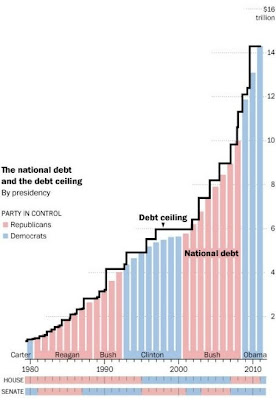

Chart of the Week: Debt Ceiling Two-Up

Everyone in Punditville (Washington, DC) is talking about it so here are the graphs. What PNG readers need to know is the debt ceiling is mostly a rhetorical exercise. The two-up played between the national parties places the blame for the debt on the majority party, totally ignoring the fact that the deficit spending causing the need for an increase in the debt ceiling has already been approved by the Congress. The wonks at the Post committed a graphical error in this otherwise instructive graph; see if you can spot it:

The debt ceiling has been raised 39 times since 1980: 34 times under those well-known fiscal conservatives Ronald Raygun and The Charlatan. The signal amid the noise is that the US is rapidly approaching the 100% of GDP threshold the investing world considers a danger zone:

Japan's public debt was 230% of its GDP in 2011. Still, in the current US situation in which a lot of dollars are owed overseas ($1.13 trillion to Japan, $1 trillion to China, or a net international indebtness of $4.03 trillion, 2011 figures) more deficit spending is not an optimal solution. Agreed, the $1 trillion platinum coin idea is a cynical response to Repugnant propaganda, but it does reveal a mindset common in Washington: as long as the government can create money by manipulating central bank accounts, it can go on spending. Eventually foreign bond buyers and dollar holders will get nervous and stop financing our profligate ways. Krugman claims he does not see any inflation, but then the price of food and gas are not even included in the consumer price index! What is needed is more revenue or less spending or both.

Japan's public debt was 230% of its GDP in 2011. Still, in the current US situation in which a lot of dollars are owed overseas ($1.13 trillion to Japan, $1 trillion to China, or a net international indebtness of $4.03 trillion, 2011 figures) more deficit spending is not an optimal solution. Agreed, the $1 trillion platinum coin idea is a cynical response to Repugnant propaganda, but it does reveal a mindset common in Washington: as long as the government can create money by manipulating central bank accounts, it can go on spending. Eventually foreign bond buyers and dollar holders will get nervous and stop financing our profligate ways. Krugman claims he does not see any inflation, but then the price of food and gas are not even included in the consumer price index! What is needed is more revenue or less spending or both.